The Quicken Loans Community Fund, City of Detroit and United Community Housing Coalition (UCHC) today announced that 557 properties entered Make It Home in 2019, bringing the program’s total to 1,157 families that have avoided tax-foreclosure related displacement since the program launched in 2017.

As of today, 241 from the 2019 group already are paid in full, and the rest are on track for completion within the next twelve months. The average price of a Make It Home property for last year’s participants was $2,880, based on a range of $1,000 – $10,700. Participants include renters and others who never held title to the property, as well as low-income Homeowners Property Tax Assistance Program (HPTAP)-eligible homeowners, who pay $1,000 to participate.

“Make It Home takes an incredibly destructive system and uses it to instead build homeownership, wealth and stability for hundreds of Detroit families, and we are grateful for our continued partnership with the City and UCHC,” said Laura Grannemann, Vice President of the Quicken Loans Community Fund. “Building upon the success of our inaugural repair program, we are thrilled to dedicate an additional $700,000 to ensure these residents are able to fund improvements that make their house feel like a home. Every homeowner should be empowered to make necessary repairs and create the home of their dreams.”

Help with home repairs

The previous 2018 cohort, most of whom became homeowners in 2019, were eligible to participate in the inaugural Make It Home repair program. An initial $300,000 investment by the Quicken Loans Community Fund provided up to $10,000 through grants and no interest loans to participants to make any necessary repairs. Forty clients participated, with most making improvements to roofs, main drains, additional plumbing repairs and procuring discounted items (fridges, hot water heaters, furnaces, etc.) through DTE. The repair program was especially critical for non-deedholders, as the previous property owners were not only behind on property taxes, but also on basic maintenance.

Monique Irvin – as well as her husband Darnell and two children – participated in the 2018 Make It Home program and became homeowners in 2019. Due to the previous landowner’s neglect, there were several improvements in the home that needed to be made immediately. They were among the first to participate in the Make It Home repair program, and utilized the grant and zero percent interest loan to put in new windows, remove a clog in their basement, fix their plumbing and purchase a new front entrance and screen door.

“I’m so grateful to everyone – the Quicken Loans Community Fund, the City and UCHC. Make It Home has been a blessing,” said lifelong Detroit resident and homeowner Monique Irvin. “Through the repair program, we were able to get all the major projects done in the house. There are still things we need, but this has been a dream come true for me and my family.”

The City of Detroit announced it will continue ensuring those who are eligible for HPTAP have access to the Make It Home program, benefitting owner-occupants who qualify for a property tax exemption and eliminating the delinquency and uncertainty of those facing the tax foreclosure auction.

“Since 2015, great partnerships like Make It Home and others have reduced the number of foreclosures in our city by nearly 95% and helped stabilize many of our neighborhoods,” said Mayor Mike Duggan. “With the expansion of its home repair assistance fund, Make It Home doesn’t just keep people in their home, it provides them the resources they need to help improve it.”

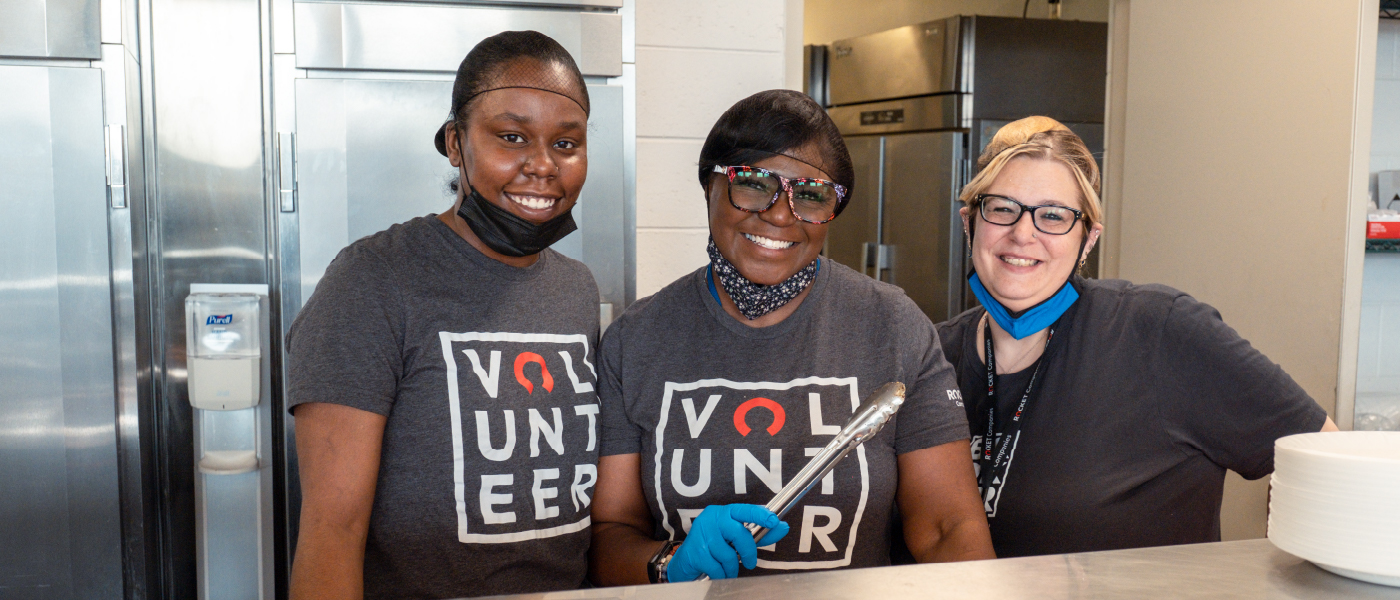

The United Community Housing Coalition, a Detroit nonprofit organization which provides comprehensive housing assistance to low-income residents, has worked to preserve and expand affordable housing opportunities for low-income Detroiters since 1973.

In addition to administering the Make It Home program, UCHC assists thousands of families each year to retain homeownership. Three days each week, residents are welcome to visit UCHC for intake hours, which include HPTAP workshops and open office hours.

“The Make it Home program is an opportunity to take tax foreclosure from a problem to a solution – instead of leading to displacement and blight, the foreclosure can lead to affordable homeownership, debt reduction, and now home repair. Every new homeowner and resident we serve through Make It Home is a success story that would have been impossible before three years ago,” said Michele Oberholtzer, Director of Tax Foreclosure Prevention at United Community Housing Coalition.

At an event today, a deed was provided to Roshona Kennedy, a 2019 Make It Home participant and Detroit’s newest homeowner. Roshona moved to Detroit when she was seven, and the home she’s resided in for years has been in her family for decades – and generations, previously belonging to her grandparents John and Ruby Webster.

“Make It Home took a lot of stress off me because I didn’t want to lose my grandma’s home. This program is the best thing that’s ever happened to me,” said Roshona Kennedy, a Detroit homeowner. “The experience of dealing with this program, thanks to UCHC, the City and the Quicken Loans Community Fund has been the best. I would recommend anybody that needs help keeping their house, or are worried about losing their family house, to look into Make It Home.”

Any funding recouped through the payment plans on Make It Home properties, as well as the repair program’s no interest loans, are reinvested into Make It Home to make it sustainable year after year.

Additional funding for Make It Home is provided by the Hudson Webber Foundation, a private, independent grantmaking organization created to support organizations and institutions that move the city of Detroit forward; United Way for Southeastern Michigan, which mobilizes the collective caring power of metro Detroit and Southeastern Michigan to improve communities and individual lives in measurable and lasting ways; and the DTE Foundation, which supports initiatives focused on arts and culture, community transformation, economic progress, education and employment, environment and human needs.

Make It Home and how it works:

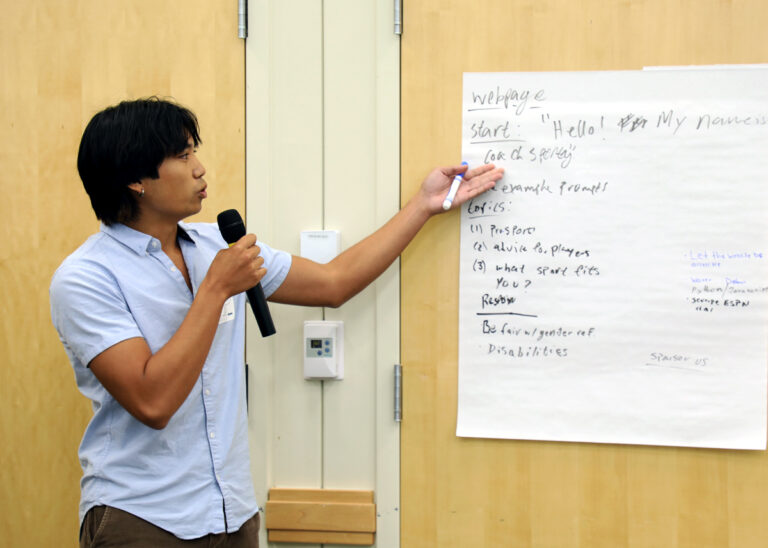

Make It Home is a partnership between UCHC, the City of Detroit, the Quicken Loans Community Fund and other funders made possible by efforts including the Quicken Loans Community Fund’s Neighbor to Neighbor initiative. Neighbor to Neighbor seeks to prevent homes from entering the Wayne County Tax Foreclosure Auction through direct outreach to all 60,000 families living in properties behind on their property taxes. Recognizing the vulnerability of renters, other non-deedholders as well as owner-occupants who are eligible for HPTAP, the parties discovered a creative solution to a complex problem.

Through the program, the City exercises their Right of Refusal, to purchase foreclosed properties before they are sold in auction, and transfers them to UCHC, who purchases them with funding provided by the Quicken Loans Community Fund and other sources. UCHC then sells them to the residents through a payment plan, upon completion of which the resident is deeded the home, free and clear.

By the numbers:

2017:

- 80 properties entered Make It Home

- 77 deeds/land contracts have been provided

- 5 properties on track to be paid in full this year

- Average price was $4,910

2018:

- 519 properties entered Make It Home

- 486 deeds/land contracts have been provided

- 33 properties on track to be paid in full this year

- Average price was $2,859

- 40 clients utilized repair program (some engaging in more than one repair)

- 18 roofs fixed

- 8 main drains fixed

- 5 plumbing repairs

- 2 porch repairs

- 1 electrical repair

- 1 foundation repair

- 26 items procured through DTE

2019:

- 557 properties entered Make It Home

- 241 properties are paid in full

- 316 properties on track to be paid in full in next twelve months

- Average price was $2,875

- Of the 557 households occupied by 1,500 Detroit residents:

- 159 are HPTAP-eligible homeowners

- 398 are non-deedholders