The Quicken Loans Community Fund today announced key findings from its 2019 Neighbor to Neighbor campaign, a partnership with the City of Detroit Board of Review to provide Homeowners Property Tax Assistance Program (HPTAP) applications to 25,000 homeowners behind on their property taxes, and a $1 million investment into the City’s 0% interest home repair loan program.

Neighbor to Neighbor seeks to both connect residents living in properties behind on property taxes with resources, while simultaneously collecting data to inform critical property tax foreclosure interventions. This effort, alongside other philanthropic investments, community action and awareness campaigns, resulted in a reduced number of occupied homes entering the 2019 Wayne County Tax Auction. Those 521 properties, including only 250 owner-occupied homes, constitute a 94% overall decrease from 2015, which saw a peak of 6,408 owner-occupied homes and 9,111 total properties enter the auction.

Detroit also had 7,601 full HPTAP property tax exemptions granted in 2019, a significant 70% increase since 2016, the last year before the pilot Neighbor to Neighbor campaign that contacted property owners at immediate risk of property tax foreclosure. The campaign also connects homeowners with ongoing Neighbor to Neighbor workshops held by the Quicken Loans Community Fund, the Board of Review and more than a dozen community partners that provide Detroit residents free assistance filling out HPTAP applications.

In 2019, those workshops accounted for 3,600 full property tax exemptions, nearly 40% of those granted.

“The Neighbor to Neighbor campaign and workshops are driving meaningful and sustainable reductions in property tax foreclosures, allowing thousands more Detroit residents to experience the housing stability they need and deserve,” said Laura Grannemann, Vice President of the Quicken Loans Community Fund. “Over the last three years, however the Neighbor to Neighbor campaign has engaged countless homeowners who should have qualified for a complete property tax exemption but were unaware of the process. In order to reach everyone at risk, we are proud to partner with the Board of Review to proactively ensure every homeowner has access.”

2020 HPTAP Applications

While nonprofit partners are still available to support homeowners in applying for the HPTAP, the Quicken Loans Community Fund made the difficult decision of cancelling the in-person Neighbor to Neighbor workshops in light of the COVID-19 pandemic.

Despite the pause in direct, in-person outreach, the Quicken Loans Community Fund has collaborated with Detroit College for Creative Studies students to create a user-friendly kit related to property tax foreclosure prevention. This collaboration served as the baseline for the 2020 City of Detroit Homeowners Property Tax Assistance Program Application and Guide, a step-by-step document that walks homeowners through the HPTAP application, lays out documents needed, and provides the prepaid postage required to mail their applications back to the Board. Additionally, the HPTAP kit also helps Detroit homeowners become eligible for the new Pay As You Stay (PAYS) program administered by the Wayne County Treasurer. Being approved for the HPTAP is a prerequisite for enrolling in PAYS.

The guide was sent to all owner-occupied homes with delinquent property taxes, those who received an HPTAP exemption within the past three years and participants in Make It Home. Those three cohorts comprised 25,000 households.

In March, Michigan Governor Gretchen Whitmer signed into law the Pay As You Stay (PAYS) bill, first proposed by Representative Wendell Byrd, supported by Detroit Mayor Mike Duggan, Wayne County Executive Warren Evans and Wayne County Treasurer Eric Sabree. The law removes all interest, fees and penalties from delinquent property taxes, or caps at 10% of the properties taxable value, whichever is less, for HPTAP approved homeowners and allows them to enter into an affordable payment plan, or pay a 10% reduced lump-sum payment to avoid foreclosure.

PAYS will result in a 50% average reduction in the delinquent tax bills owed by Detroit homeowners eligible for HPTAP.

“Since 2015, we have made continued progress in helping Detroiters stay in their homes,” said Detroit Mayor Mike Duggan. “I thank the Quicken Loans Community Fund, our community partners and City of Detroit Board of Review for expanding access to programs like HPTAP, Make it Home and Pay As You Stay, which are designed to help Detroit homeowners most in need.”

Earlier this year, the Wayne County Treasurer’s Office announced it would not foreclose on any homes in 2020, and it cancelled the Tax Auction slated for this fall. Despite the moratorium on tax foreclosures this year, it is critical that Detroit homeowners apply for HPTAP as soon as they can to avoid future tax delinquency.

HPTAP applications, as well as free by-phone assistance for residents who need help completing their HPTAP application and enrolling in PAYS, are also available at the following organizations, who previously held Neighbor to Neighbor workshops in conjunction with the Quicken Loans Community Fund and Board of Review:

The City has also made HPTAP applications available online and waived the notarization requirement for 2020, and community partners listed can assist residents with the online HPTAP.

Key Findings From the 2019 Neighbor to Neighbor Campaign

Last year’s Neighbor to Neighbor campaign saw an increase in the number of individuals who self-reported they would be eligible for a complete property tax exemption based on income guidelines, with 87% of homeowners surveyed reporting they met the threshold. A staggering 55% indicated they were unaware of the HPTAP exemption.

Of the 6,242 renters in occupied homes that were tax delinquent, 75% of those who would be eligible for the Make It Home program said they were interested in owning their home. Turning renters into homeowners is one of the most impactful ways to address tax foreclosure because it keeps residents securely housed, creates new homeownership and prevents a property from entering the tax foreclosure auction.

Many Detroit residents in tax delinquent properties identified significant repair needs, with 38% of 13,889 homeowner-occupants contacted by Neighbor to Neighbor stating their structures need critical maintenance. Homeowners are often forced to make decisions to defer upkeep in an effort to maintain ownership, creating potentially unsafe conditions for elderly residents, children and others.

To address this, the Quicken Loans Community Fund has made $2 million of investments into increasing access to repair resources. Most recently, they made a $1 million investment into the City of Detroit’s 0% interest home repair loan program, which provides loans of up to $25,000 to Detroit homeowners.

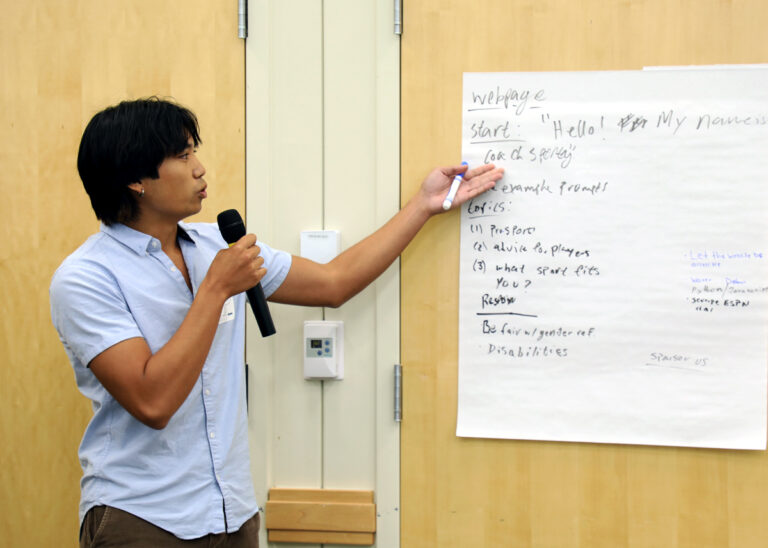

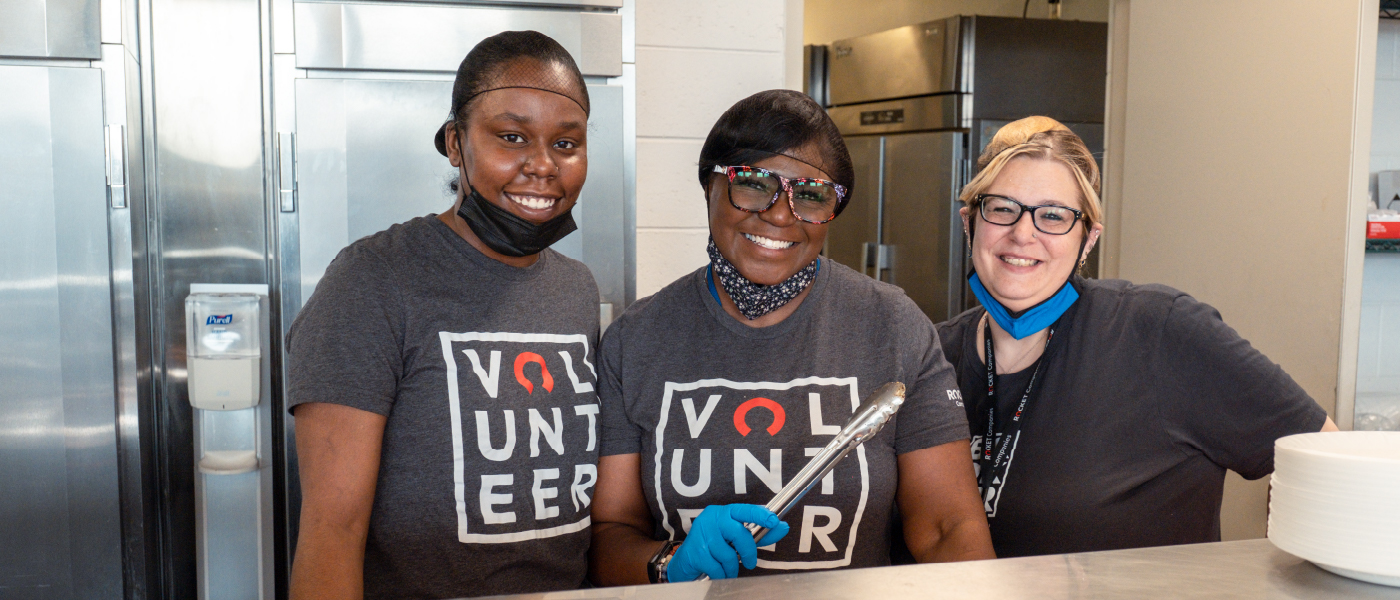

Overall, the 2019 Neighbor to Neighbor campaign saw a 59% contact rate, a nearly 7% increase over 2018. The 150 paid canvassers were Detroit residents hired by partner organizations through grants provided by the Quicken Loans Community Fund.

The entire Quicken Loans Community Fund Neighbor to Neighbor 2020 Update can be viewed here.