The Gilbert Family Foundation (GFF) and Rocket Community Fund today announced an unprecedented and transformational $500 million philanthropic investment over the next ten years, to be accomplished through strategic contributions to community organizations that will build economic opportunity in Detroit neighborhoods. The Gilbert Family Foundation will contribute $350 million, and the Rocket Community Fund will invest $150 million.

The investments were announced at an event with Gilbert Family Foundation founders Dan and Jennifer Gilbert, Rocket Companies CEO Jay Farner, Rocket Community Fund Vice President Laura Grannemann, Gilbert Family Foundation Executive Director Joyce Keller, Detroit Mayor Mike Duggan and Wayne County Executive Warren Evans. The philanthropic strategy will focus on building on-ramps to economic stability through investments in breaking down generational barriers and jumpstarting opportunities for economic stability and wealth creation.

The Gilbert Family Foundation – Eliminating Property Tax Debt for Low-Income Homeowners:

An initial $15 million investment from the Gilbert Family Foundation will completely eliminate the property tax debt owed by an anticipated 20,000 low-income homeowners in the city of Detroit. In doing so, the Foundation assists in preserving an estimated $400M wealth and home equity in Detroit.

“Everyone deserves to achieve the American dream of homeownership, and that includes the ability to sustainably and permanently enjoy the home you make for yourself, your family and your loved ones,” said Dan Gilbert. “The greatest resource of any community is its people, and we are honored to be able to invest in removing this tax burden, which will build a stronger foundation for Detroit families to thrive.”

Low-income homeowners are eligible for the City’s Homeowners Property Tax Assistance Program (HPTAP) – a partial or complete property tax exemption. However, many homeowners previously fell behind on their property taxes, not knowing about this resource, and are still struggling to overcome debt from years past, including interest, penalties and fees.

This investment will establish the Detroit Tax Relief Fund, which will be administered by Detroit nonprofit Wayne Metro Community Action Agency and allow the organization to scale their programming and services. Upon confirmation of eligibility, Wayne Metro will pay the remaining delinquent tax burden on behalf of residents.

Following the first initiative, the Gilbert Family Foundation plans to remain connected to the homeowners supported through the Detroit Tax Relief Fund to shape future investments in economic opportunity and mobility. The Gilbert Family Foundation will build short-term and long-term partnerships that break down systemic barriers, create new community-informed resources and successful program scale. Further investments will be focused on community priorities and may include digital equity, home repair needs, employment opportunities and other areas. The Gilbert Family Foundation also remains committed to supporting efforts to cure neurofibromatosis.

Community engagement has been foundational to the creation of the Gilbert Family Foundation’s philanthropic strategy. Over the course of 2020, Gilbert Family Foundation cofounder Jennifer Gilbert held focus groups with Detroit leaders and residents to better understand the challenges and gaps that exist in Detroit. Two overwhelming themes emerged: Detroiters are resilient, and Detroiters need greater access to opportunity.

“Big problems require even bigger solutions that address the symptoms as well as the systems that have contributed to the challenges Detroit continues to face,” said Jennifer Gilbert, co-founder of the Gilbert Family Foundation and founder of several successful Detroit-based companies. “We look forward to working with existing and future partners to drive systemic change in Detroit.”

Non-profit organizations and individuals interested in learning more about future requests for proposal from the Gilbert Family Foundation can visit www.GilbertFamilyFoundation.org.

The Rocket Community Fund:

The Rocket Community Fund will also invest $150 million of the overall $500 million commitment into Detroit over the next ten years, continuing to focus on its primary issue areas of housing, employment and public life. It is the Rocket Community Fund’s flagship Neighbor to Neighbor program that helped drive an unparalleled 94% reduction of the number of homes entering the 2019 Wayne County Tax Auction compared to 2015. The number of owner-occupied homes that entered the auction – only 250 – was the lowest in more than 15 years.

The Neighbor to Neighbor outreach also identified a need for the Make It Home program, which supports renters and low-income homeowners vulnerable to displacement due to property tax foreclosure. In conjunction with the City of Detroit, United Community Housing Coalition and additional partners, Make It Home has helped more than 1,100 Detroit families stay in their homes and simultaneously created hundreds of new homeowners.

Rocket Companies Chairman Dan Gilbert has been a vocal proponent of holistically addressing housing stability since chairing the Detroit Blight Removal Tax Force in 2013. His organizations’ philanthropic strategy in housing stability and other Detroit-based efforts has been guided by Laura Grannemann, Vice President of the Rocket Community Fund.

“This unparalleled commitment builds off of the work we have done over the past several years and scales it in a way that will allow us to continue addressing issues that have been facing Detroiters for generations alongside the Gilbert Family Foundation,” said Grannemann, Vice President of the Rocket Community Fund. “This impactful announcement comes with a promise of a brighter future and a deepened commitment to Detroit.”

Outside of housing, the Rocket Community Fund has a long track record of impactful investments in employment and entrepreneurship that bring together philanthropic capital, policy advocacy, technology and team member talent. The Rocket Community Fund serves as national youth development nonprofit Urban Alliance’s anchor employer in Detroit for its flagship youth employment model and works with the Detroit Police Athletic League (PAL) on mentorship and educational programs. It is also a partner in Connected Futures, which provided more than 44,000 Detroit Public School Community District students with tablets and internet access amidst the ongoing pandemic. Its annual Rocket Mortgage Detroit Demo Day entrepreneurial pitch competition has provided more than $4.4 million in Detroit-based startups and businesses over the past four years.

Additionally, the Rocket Community Fund sponsors numerous programs, events and activations all across Detroit, increasing access to safe, inclusive public spaces and events that build economic and social resiliency and spark bonds within the community.

Rocket Companies (NYSE:RKT) CEO Jay Farner, who also serves as Chairman of the Rocket Giving Fund, the 501(c)3 that administers the Rocket Mortgage Classic, recognized the historic day.

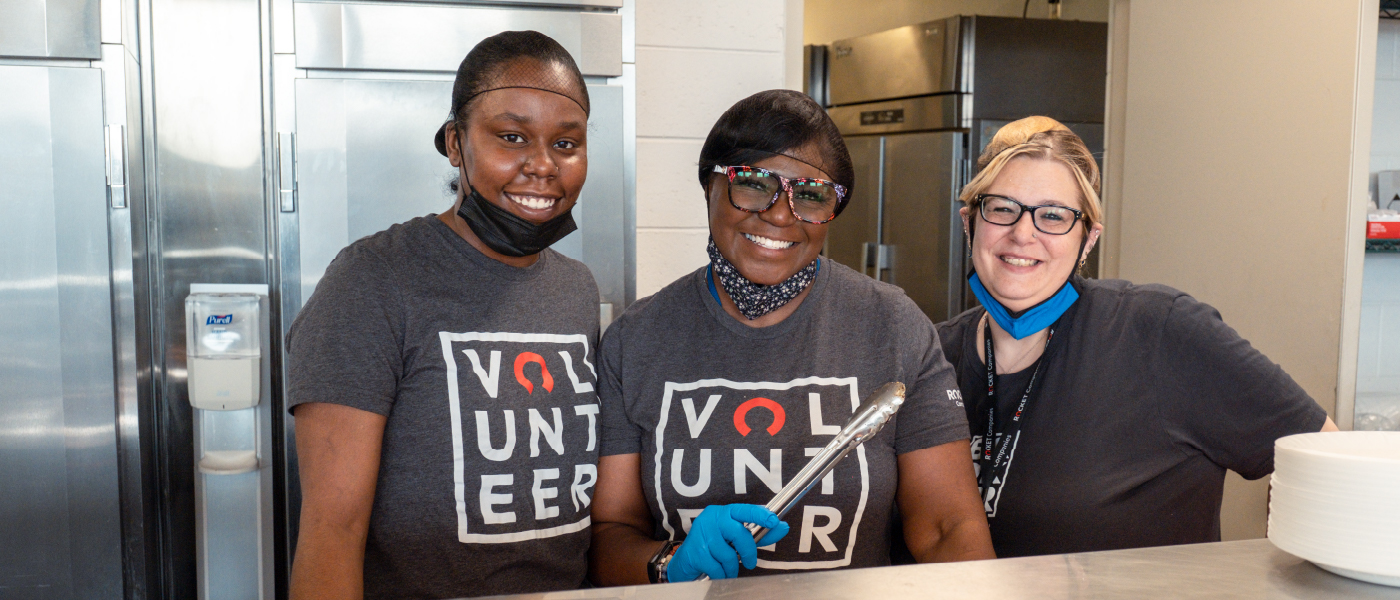

“We are proud to be Detroit’s largest employer, and strive to lead by example every day,” said Farner. “Detroit is the city where thousands of our team members live, work and play, and where they have contributed more than 415,000 hours of volunteer time. Eleven years ago, we began moving our business to Detroit, and today further confirms that we are committed to the city’s future.”

Farner and the Rocket Giving Fund have been active in efforts to address the digital divide through the Connect 313 Fund, established alongside the City of Detroit and administered by the United Way for Southeastern Michigan. The Fund, through the Rocket Mortgage Classic and additional grants, has raised more than $6 million in the past year. Today’s announcement will aid efforts to transition Detroit from the least-connected large city in America to a model for digital inclusion and equity.

Accessing the Detroit Tax Relief Fund:

During the Rocket Community Fund’s 2019 citywide canvas of tax delinquent properties through Neighbor to Neighbor, the organization discovered nearly 90% of Detroit homeowners behind on their property taxes should have been able to qualify for HPTAP but were not aware of the program or were unsure of how to apply.

The Detroit Tax Relief Fund, in conjunction with ongoing efforts, will work to reduce the cycle of property tax foreclosure and preserve hundreds of millions of dollars of equity in Detroit.

Detroit homeowners who have received or are eligible for the Homeowners Property Tax Assistance Program (HPTAP) and the Pay As You Stay (PAYS) program can learn more by calling (313) 244-0274 or by visiting Wayne Metro Community Action Agency website.